Governing a $200 billion super fund

Fund governance was a recurring theme of the recent ASFA conference.

It’s something we are going to hear a lot more of.

Danielle Press, the new CEO of EquipSuper, offered a fairly blunt contrast of the super industry’s expectations of governance from its investments and fund managers; and the (lesser, in her view) governance standards that the industry applies to itself.

The presentation of APRA’s Ross Jones was a clear indicator of how the bar will rise. Ross signalled that information requirements were going to rise substantially, although he felt that the metrics required would not be anything more than a fund’s management team and board should be considering already. Reading between the lines though, it suggests there may be some gaps.

Ross also referred to APRA’s lack of powers over super funds, arguing that APRA has more power over the smallest credit union than the biggest super fund. Not much reading between the lines needed here.

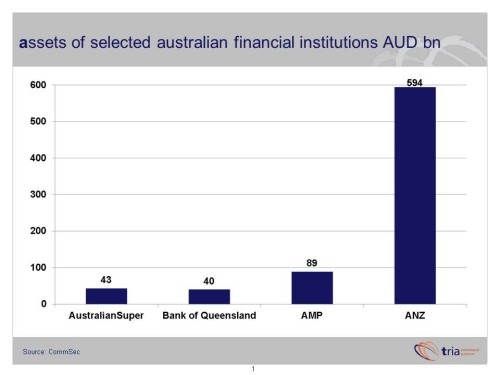

This week’s chart compares the balance sheet assets of a number of Australian financial institutions. Our largest super fund AustralianSuper has assets of $43 billion – similar to a regional bank like Bank of Queensland, and about half the size of AMP. All of these are dwarfed by the assets of any of the big four banks – ANZ for example has assets of nearly $600 billion.

Interestingly, ANZ’s shareholder equity is $38 billion, giving it a similar equity size to AustralianSuper (super funds are essentially 100% equity, compared to banks which are highly leveraged).

There is a vigorous ongoing debate about the need for and role of independent directors, especially for funds with boards split between employer (typically employer associations) and employee (typically trade union) representatives. It’s an equally interesting question for retail for-profit funds.

Tria addressed the need for better governance and reporting in the context of the future $5 trillion industry. We looked at the implications of an industry where the largest funds will be hundreds of billions of dollars in size:

– The largest funds will have assets well in excess of regional banks or large insurers today – both of which are much more closely regulated. It’s very hard to imagine that funds will be given as much leash as at present.

– Funds will be an enormous honey pot which need to be guided and protected from external and internal temptations. The potential for large frauds and corruption are obvious and there are plenty of overseas examples to point to.

– With so much at stake, we need to ensure that management teams and boards make good decisions. This requires expertise, and diversity of views and perspective. There is an argument that the pool from which funds currently draw management and board members at present is too shallow, and needs more outside expertise.

– Big funds will also be larger than most public companies, but currently report a fraction of the information. By and large, the current standard of formal reporting such as annual reports is appalling in terms of useful information for comparing performance.

– There are examples of good progress in reporting investment exposures – AustralianSuper has reported its mandates for several years, and Cbus upgraded its reporting substantially this year.

– In contrast, the reporting of even basic financial information such as P&L and balance sheet is often poor. Funds need to put their detailed financial statements into public domain (ideally on their website), just like a public company. The fact that most members will never refer to them is irrelevant. Neither do the vast majority of public company shareholders. It’s about transparency and the disinfecting power of sunlight.