Active ETFs – growth path or garden path?

One of the notable features of a managed funds industry under pressure has been a rotation towards the listed environment. Key aspects of this rotation have included migration by investors and planners from equity funds to direct shares, SMAs, equity models, and ETFs.

Coming up fast behind this is the ASX’s AQUA II operating environment, which will allow unlisted managed funds to be traded centrally via the ASX, rather than investors having to deal separately with each fund managers’ back office processes. [Any questions about AQUA II vs ETFs, give us call].

The potential for significant efficiencies for investors arising from a single operating environment is clear. Equally, the impending arrival of AQUA II is causing active asset managers to think about the ASX as a distribution channel rather than a competitor.

The next logical step for active managers is to start asking about active ETFs. Despite a pause in growth over the last year, we see ETFs as located at an attractive point in the S curve – at the base of the high growth phase.

There’s a lot of buzz about active ETFs, but is this going anywhere?

So far, there’s more talk than successes which can be pointed to.

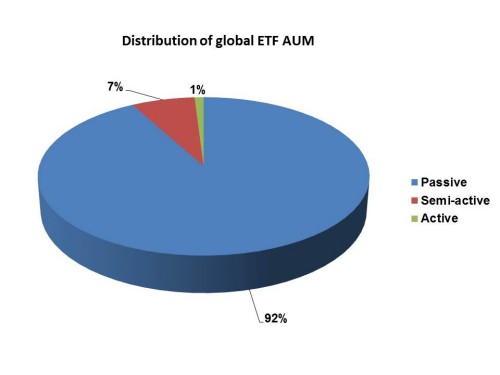

The vast majority (92%) of ETFs assets globally is truly passive, tracking leading market indices. Of the balance, less than 1% reflects ETFs where an active asset management team is making daily fundamental investment decisions.

The biggest traditional problem with active ETFs is that fund managers must disclose their holdings on a daily basis to the market or at least the members of the fund. This enables the creation or redemption of units by market makers and ensures the listed price closely tracks the fund’s NAV. As a result the manager’s holdings and active decisions are instantly visible. Most active managers aren’t comfortable with that.

The exception is fixed income, where it is more difficult to replicate a manager’s holdings or front-run trades. The best example of an active ETF success can be found in this asset class – Bill Gross’ $260b PIMCO Total Return Fund does not track an index, and was made available as an ETF in March this year. The Total Return ETF has taken $2bn in flows since its launch and has outperformed the mutual fund equivalent by around 2% in that time.

Located between these extremes is around $100b of ETF assets that are neither fully active nor purely passive. Most of these ETFs track a rules-based or custom index of some kind, but the investment proposition is generally that the ETF will outperform the index more commonly related to the asset class.

An example is the Powershares DWA ETF, which tracks an index selecting US equities on a proprietary relative strength calculation – it’s really a quant momentum model. The ETF has outperformed the S&P500 by 0.8% pa since inception.

Local examples include the ETFs tracking high-yielding equity indices. While these aren’t necessarily trying to outperform the total return of the broader benchmarks, they are providing targeted outcomes classically offered by active managers.

We like the prospects for these semi-active ETFs. Products with a good chance of success include investment strategies that are difficult to replicate (so the manager / index provider isn’t concerned about replication or front-running), and those which address core needs of significant investor constituencies. A covered call strategy fits the bill, as do a range of quant strategies, geared equity (using debt, not derivatives) plus many more.

It is in these types of products that we expect to see the hype around active ETFs approach the reality.

That being said, the Australian ETF business case remains a challenge to construct. ETF businesses are expensive to develop and operate. The back office requirement is sufficiently different to often warrant outsourcing, which is expensive. You’re likely to be marketing to a different target market and dealing with many new relationships (such as market makers) and operating tasks.

The alternative solution – but potentially just as viable if the ASX executes well – is to put a regular fund on AQUA II, and build support for that model.