Beyond technology – 6 groups doing interesting things

It’s amazing what you come across in the archives.

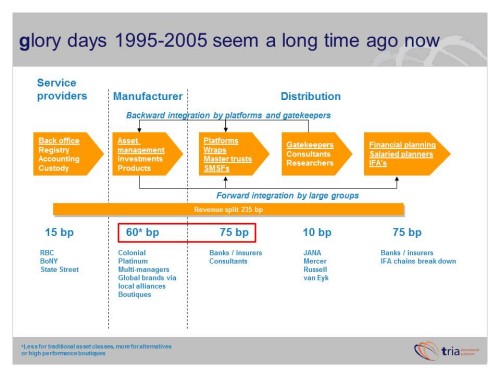

In the process of preparing for our FSC conference presentation last week, Beyond Technology, we came across today’s diagram, a value chain of the industry around 1995-2005 when it was at the peak of its pricing power. It provides a remarkable comparison to the industry conditions of today:

– The value chain totaled 235bps. Under MySuper, we’re looking at 75-125bps.

– Asset management comprised ~60bps, a weighted average of passive, traditional active, and alternatives / high performance boutiques. Today, perhaps half to two thirds of that level.

– Platforms comprised ~75bps. This is where the pain has really been felt, with platform prices now half this level or less. Ironically the area where platform prices have held up – for now – is SMSFs.

Volume changes are also at work, reinforcing margin pressures. Ten years ago this value chain was dominant; pretty much all the money flowed through it. Now, thanks in large part to changing technology, it’s possible to bypass part or all of it, so the value chain has sprung some serious leaks. This has particularly impacted the ability of platforms to act as toll-gate.

Below are 6 groups – large and small – who have been doing interesting things in a difficult industry environment. Note this does not necessarily mean they will be successful in revenue or profitability terms – some will crash through and some will crash. But they are all interesting and different responses to prevailing conditions:

– BTFG: for Super for Life. It showed you could distribute super over the counter to consumers. It also pointed to the possibilities of bundling super and banking, using simplicity and convenience as a proposition rather than performance or complex features. Most bank competitors have since followed.

– UBS Platform Solutions Group: for direct-to-consumer wrap capability being taken up by the not-for-profit segment. It can be a bit clunky as it often has to be stapled to a core system (eg Superpartners). But it gives not-for-profits a fast, low risk path to market with a product for their high balance members, and it’s one of those dangerous “good enough” products, delivered at low price, which gets better over time.

– Calastone & ASX: for their connection technologies. Calastone greatly improves the efficiency of the connection between platforms and fund managers. The ASX has potential to reshape the connection between investors and funds if we ever get AQUA II. Both extend the reach of funds and greatly reduce the cost and hassle of using them.

– SelfWealth: for creating an online community for self-directed investors. It allows investors to compare portfolios, and is working on its own benchmarks and portfolios. SelfWealth has a subscription business model, but you could see it as a distribution channel too – perhaps something like the Motley Fool.

– Montgomery Investments: for its use of media. Montgomery targets self-directed individuals with absolute return style products and a very personal, almost artisan-type experience. Not cheap either. What really marks out this business is how effectively it uses media, both traditional and new media, everything from a column in the Weekend Australian to the Eureka Report.

– GDI: one of the few success stories in marketing to SMSFs. GDI raises capital for single property funds offering a good tax effective yields, and has completed 27 funds since 1993. Another very personal experience for the investors both in terms of the asset and the fund experience, which is about as far away as you can get from the impersonal and opaque experience of the typical managed fund. This approach has allowed them to build a network of over 1,000 HNW investors, almost a club.

What these initiatives have in common is that they steer clear of the middle ground. Some are big scale, low cost plays, others are artisan high cost plays; the Coles $1 and Sonoma loaves of the bread industry. Both approaches can work. What you don’t want to be is the middle ground Helga’s loaf of wealth management.