Lowering super’s cost structure – what are the trade-offs?

What are the trade-offs involved with reducing the cost structure of super?

One of the problems with the Grattan Institute view is that it essentially argues that a free lunch is available – ie you can slash costs in super, such as removing active asset management, without any negative consequences.

Not only is this highly questionable, it’s far from a complete view. A good example is that the cost debate, including the Grattan report, is selective. For example, it ignores that for many members, their biggest cost is not administration and investment fees at all – it’s insurance premiums. Quite apart from getting your priorities right, insurance demonstrates that there aren’t any free lunches. If you want lower costs, it involves trade-offs – you can have lower insurance premiums, but you have to trade off benefits.

It’s the same in super. You can have lower costs, but what do we have to trade-off to get them?

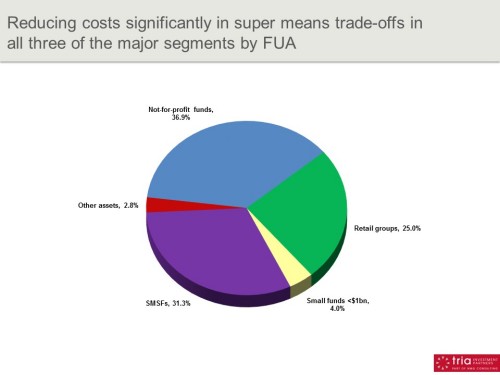

To make a significant difference, you need to act on each of the three main super segments highlighted in today’s chart – SMSF, retail, and not-for-profit. What you need to trade off is different in each case.

For SMSFs, which have 31% of the super system, the main driver is administration costs. SMSF costs are largely fixed, with some variability for complex SMSFs, in the region of $1,000 upfront and $3,000 pa. Although costs are drifting down over time, they remain a significant impost for smaller SMSFs:

– For a $1m SMSF, the annual administration costs are 0.3% pa

– But for a $100,000 SMSF, annual administration represents 3.0% pa

If you’re serious about reducing costs in super, you cannot ignore a 31% segment. And for SMSFs, given a largely fixed cost structure, the trade-off required for a lower cost structure is that you have to restrict the formation of small SMSFs. According to https://www.learntotrade.co.za/, te economics of SMSFs under $500,000, by and large, do not stack up.

Retail is a different story. The problem is not prices facing customers in products launched since FoFA and Stronger Super. At

But those trade-offs have already been made:

– Backbook products relating to default super (ADAs) will be converted to MySuper products by 2017, which will bring these prices down automatically.

– Other backbook products have been grandfathered by FoFA. They will run off over time, but beyond new legislation to override FoFA – constitutionally difficult – the trade-off has been done already.

The final segment is not-for-profit. As we discussed here a couple of weeks ago, the biggest cost driver here is active asset management (it’s also significant in retail), so if you want to drive down costs in not-for-profit, you are talking about switching to passive management of public market assets, and removing relatively expensive private market assets entirely.

Most not-for-profit CEOs would consider this a bad trade-off which will leave their members worse off in net terms, especially funds like REST which have done well from their active managers.

But there is also a national trade-off in what is sought from super, which reflects some fundamental contradictions in the debate. If you really want low costs, as outlined above, you have to go passive. But at the same time, the government wants the super system to fund new infrastructure, the needs of growing local companies, and to bail out the financial system when it gets into difficulty. That’s active management.

You can’t have it both ways, and that’s the trade-off. If we want a flexible super system which can make major investments in infrastructure and respond with large amounts of capital in times of great national need, you have to accept higher costs. The financial crisis demonstrated that what mattered when the chips were down was not the cost of the super system, but its ability to step up with urgent recapitalisations when banks and major companies might conceivably fail and take the economy into depression. What’s the cost of that scenario? A passive system might be low cost, but it is going to struggle to do much else.

There really is no free lunch.