Retirement Incomes – Part I

It is well understood that the superannuation system, ostensibly created to generate incomes in retirement, has really been developed with a focus on accumulating balances rather than income streams. A necessary reorientation is now underway across the industry but the optimal retirement income solution is not yet evident. Over the next three weeks we will be exploring some of the issues and the different solutions available.

Today we will look at the demand themes and one category of solutions: account based pensions.

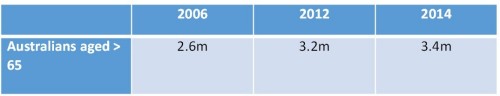

When the first cohort of Australia’s 5.5 million baby boomers hit 65 a few years back it was just the start of a rapid increase in the number of people entering retirement. And yet, the superannuation system is still maturing: average balances at retirement are rising rapidly and will continue to do so for more than a decade (even if you assume no investment returns).

- Growth in Australians aged > 65

Source: Australian Bureau of Statistics

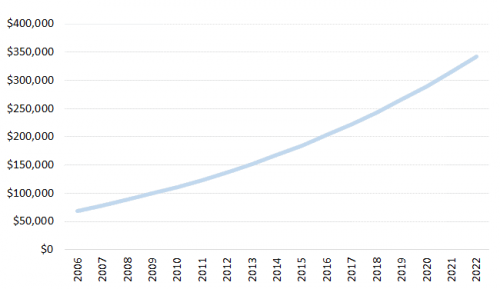

We know that member behaviour at retirement depends at least in part on their balance – members with lower balances are much more likely to take a lump sum payment and live on the pension, whereas those with higher balances tend to remain in the system, putting the money into an allocated pension product (and generally with the assistance of an adviser). So it’s important to note how balances at retirement are growing over time:

- Super Balance at retirement – individual earning average wage, working full-time

Source: Tria

This growth in balances at retirement is driven primarily by a maturing superannuation system (the first Australian to have contributed to superannuation during their entire working life won’t retire until around 2040) as well as some additional pick-up from the planned (eventual) increase of the superannuation guarantee to 12%. If behaviours remain the same, higher balances will mean more Australians choosing to remain in the system rather than cash out their super in lumps sums. So the industry has to have a better set of solutions for decumulation than it does right now.

Last year’s Financial System Inquiry agreed with this view, recommending a Comprehensive Income Product for Retirement for members.

It is clear that the opportunity is large and growing – so it is worth looking at the range of potential responses, which we group loosely into three categories, listed below, before we look at account-based pensions in a little more detail. Each category represents an opportunity for the main cogs in the for-profit value chain as well as the not-for-profits:

- Account-based pensions – traditional, non-guaranteed investment strategies

- Guaranteed products – mostly taking the form of annuities, either regular or variable

- Non-guaranteed longevity protection – a hybrid with some of the design features of both account based pensions and guaranteed products

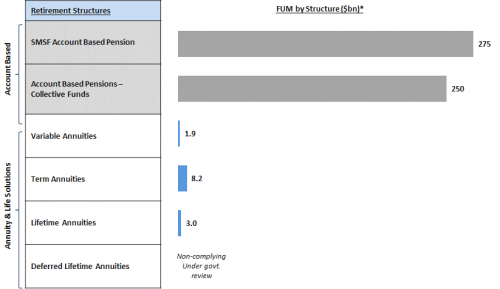

Account based pensions are the dominant retirement vehicle in Australia. As the chart below illustrates they are by far the largest (they are also the fastest growing):

The success of account-based pensions is due to their simplicity (they are underpinned by traditional investment strategies which advisors are comfortable explaining), flexibility (a range of investment strategies are available) and control (retirees retain full access to their capital). They are also the default option for all defined contribution superannuation funds in Australia and the structure of SMSFs in pension phase.

Account based pensions are well-supported by advisers. Almost all gross flows to account based pensions on retail platforms are adviser-directed as there is an important role for advisers to play in ensuring members optimise their retirement outcomes through an account based pension. After all, how can members be expected to know how much of their balance to withdraw each year to ensure it lasts the distance?

And this is where account-based pensions do fall short as a retirement solution. The elements of control and flexibility they offer means they do little to mitigate key risks including sequencing risk, longevity risk and to some extent poor investment performance. The opportunity is to begin addressing some of those issues.

So should your organisation focus its attention here?

Account based pensions are where all the money currently is, so it would seem sensible to develop a product that suits this structure. Particularly for asset managers who will find it substantially more difficult to compete in the other product categories (to be covered here in coming weeks). Account based pensions are underpinned by the traditional investment solutions at the core of an asset manager’s proposition and importantly, don’t require the backing of a balance sheet.

The market for account based pensions is hotly contested. New entrants will require a solid strategy if they are to compete. Expect to see more complex solutions here as asset managers globally get to grips with the demographic shift to retirement.