DC workplace pensions: rising flows and more switching will tempt entrants

The minimum contributions ramp-up is helping drive growth in DC workplace pension flows. In parallel, the switching “secondary market”, long predicted but slow to emerge, is also picking up steam. Against a slow growth UK wealth market, these dynamics make workplace pensions appear tempting for entrants. But with profitability elusive, is this actually a siren song?

DC workplace pensions now represent ~40% of total DC pension flow (including personal pensions), up from ~35% in recent years. With rising minimum contribution rates still to fully feed through, and individual DB pension transfer volumes flat at best, the flow share of DC workplace may rise further.

But will employers switch workplace pension providers and make enough of the opportunity contestable? If so, how many and how often?

This is an important question for workplace pension participants post AE onboarding. With all employers “in the system”, genuine new business is now limited to new employer formation and employer restructuring.

Around 400,000 UK employers are established each year, but most are small, and few start with significant workplace pension assets or annual contributions. With new business from these sources limited, competition in workplace pensions is primarily for the stock of existing assets and related contributions – ie employers switching away from incumbent providers.

In theory a healthy switching market should emerge. Employers would review their workplace pension provider every 3-5 years; a proportion would switch due to dissatisfaction or a more competitive offer. A case could be made for 5-10% pa of DC workplace AUM being switched.

In practice this has been slow to become visible, with some justification. Employers which have recently implemented decisions, and incurred the operational challenges that go with pension change, are unlikely to want to revisit it for some time.

However we are now far enough away from the AE onboarding dates for the implementation pain to have faded sufficiently (for some employers at least), and for a review / switching market to develop. This is largely borne out by NMG’s 2019 Corporate Wealth Study.

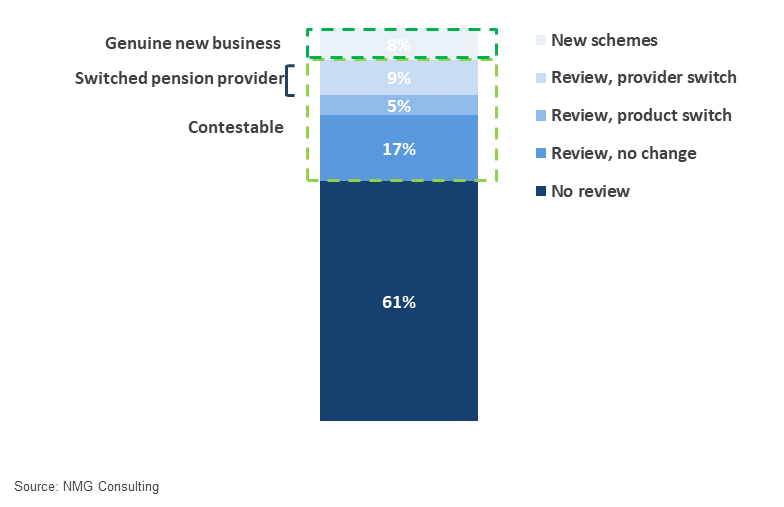

Figure 1 shows the consolidated movement in corporate intermediary client portfolios over the 12 months to mid-2019, by number of client accounts (not AUM).

FIGURE 1: UK DC WORKPLACE PENSION REVIEW & SWITCHING ACTIVITY 2019

This shows:

- There is still new business, but as noted above, these opportunities are typically small in flow terms.

- One third (31% of 92%) of the existing client book was reviewed in the past year – this represents the potential contestable market.

- Half the potential contestable market stayed with the incumbent provider and product; another sixth switched product only.

- Just under 30% of the contestable market switched provider; ie the switching market was reported as 9% of the existing book of corporate intermediaries.

A 9% switching rate is at the upper end of our hypothetical range, suggesting that intermediaries may be overstating. It is certainly higher than the level of observed DC AUM switched, which we currently estimate at <5%. However these are not necessarily incompatible; employers switching may simply be smaller than average in AUM terms.

Why do advisers recommend their employer clients switch workplace provider? The Corporate Wealth Study shows it’s mostly because the costs of bad experience overtake the costs of switching:

- Quality of operational support and accuracy of administration still dominate the switching decision.

- Price, which is a major initial selection criteria is typically less important in the decision to switch (partly because low price can also equate in practice to poor delivery).

- Poor investment performance is still a relatively minor switching factor (which continues to surprise us given it is one of the key levers in employee outcomes).

Workplace switching is currently almost entirely driven by the employer’s experience rather than the employees’. There are indications that this may re-balance in the next few years, something we will explore in an upcoming edition.

However, employer experience is itself enough to generate a healthy level of switching, if more so in employer numbers than assets. That should be temporary; given the rapid growth in DC workplace assets, contestable AUM will become increasingly significant over time.

That’s the good news for workplace pension participants. The bad news is that everyone will be looking at the same dynamics – any UK strategy must include how to participate in, or get exposure to, the growth of DC workplace pensions. If you are not there in some form, growth will be hard to come by.

Often that will be indirectly, such as advice-led individual products near retirement (the traditional retail strategy), or by providing services such as asset management to workplace pension participants which need to go external. But some new entrants will be tempted by the growth prospects to directly enter the DC workplace pensions market, both established and new UK financial brands, and major offshore financial brands.

Competition in workplace pensions, already intense, is therefore unlikely to slacken soon. That, the prevalence of price-based propositions, and the presence of strong not-for-profit participants, are likely to reinforce the category’s reputation for being a largely margin-free zone, making understanding and targeting the drivers of workforce pension profitability essential if ongoing losses are to be avoided.

For more information, contact:

Andrew Baker, Partner (London; [email protected])

Ralph O’Brien, Senior Consultant (London; [email protected])