Trialogue – DDO delivers manufacturers an (unexpected) data opportunity

Regulators are baring their newly-sharpened teeth empowered not only by the Royal Commission findings but also new legislation. Earlier this year, two additional regulatory reforms were introduced that promise to invite ASIC even more deeply inside the operations of product manufacturers, issuers and distributors:

- Product Intervention Powers, which allow ASIC to step in and halt the sale of a product where they determine that the product (or class of products) has – or will – result in ‘significant consumer detriment’; and,

- Design and Distribution Obligations (DDO) for manufacturers, issuers and distributors of retail financial products.

These reforms move the industry away from the ‘buyer beware’ stance that has been universally accepted to date and into ‘seller – be wary’ territory. Our discussions with issuers, manufacturers and distributors on these reforms suggest many may be taking a “tick a box” approach to the DDO. However, we think this may be short sighted. Rather than seeing the DDO as a mere compliance requirement we think some participants will turn it to their advantage. How? Embrace the DDO and use the new legislation to your (competitive) advantage.

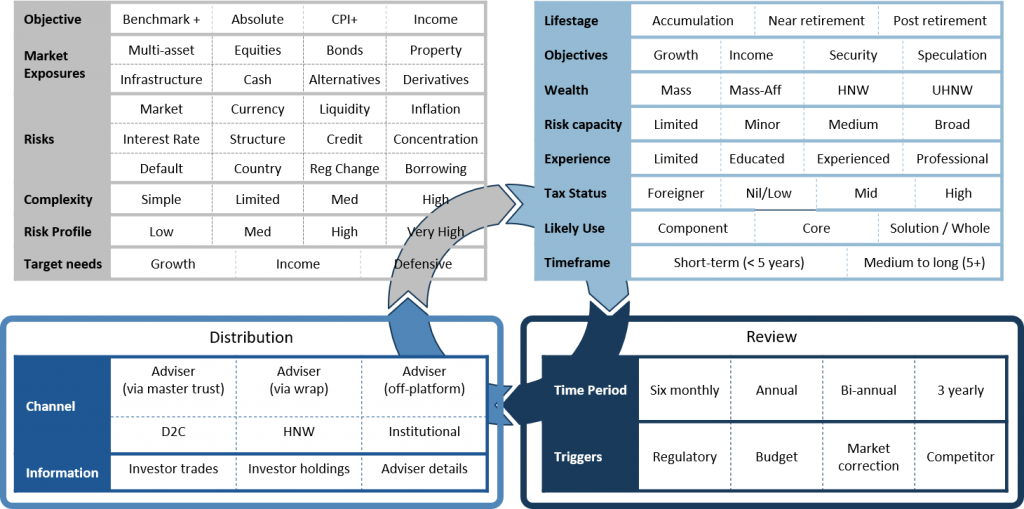

The DDO, commencing in April 2021, is designed to ensure retail products are fit for purpose and distributed to appropriate end consumers. At the core of the obligations is the requirement to specify a target market determination (TMD) for each retail product – this includes managed funds but also platforms. All product manufacturers will need to consider many potential factors to land on a TMD – some examples are shown in the diagram below:

Potential DDO considerations for issuers, distributors and manufacturers

Of course, the furphy of the entire process is that more than 90% of managed funds are suitable for all (or very nearly all) investors. Even looking at all the permutations in the diagram above, it’s difficult to establish that (without understanding a client’s entire portfolio, their risk appetite and personal goals) a large cap global equities fund would be more or less suitable for any individual – and the same goes for most fixed income funds, domestic equity funds and multi-sector funds as well. The other issue with the DDO is that in the advised market it effectively replicates the requirement to test for suitability – traditionally the role of the adviser but now apparently a requirement for manufacturers as well. Is a fund manager or platform provider really well-placed to assess whether their product is suitable for an individual investor?

The obvious answer is no, but it seems like there will be a requirement to do so anyway. And the silver lining is that manufacturers will need to collect a whole host of data in order to comply with DDO – data that isn’t currently available to them.

This data clearly has potential value, and we think there is an opportunity for providers to use the data and take the next step in relation to:

- Engaging with end clients directly through improved marketing and retention strategies

- Improved segmentation to inform distribution and marketing activities; and

- Better decisions about product enhancements, communication strategies and/or pricing to maximise value.

We think more progressive providers will integrate data-driven insights throughout their product lifecycle (launch, growth, maturity and decline) to create a flexible, responsive and effective framework for product design and management.

While some providers are no doubt developing their consultation response thinking about how to comply with the new DDO obligations, along with the cost and resourcing impacts, we believe more progressive providers will be thinking more about the opportunity, and what data they can use to better inform decisions and engagement with their products.

For more information, contact:

Rebecca Clouston, Consultant ([email protected])

David Hutchinson, Principal Consultant ( [email protected])