ESG: what asset owners want from ESG – and their asset managers

ESG is going mainstream, but what asset owners are seeking to achieve and the role of their asset managers is still poorly understood. NMG’s new Global ESG Study provides answers to the big ESG questions. Based on interviews with over 200 asset owners and 800 responses from US plan sponsors and advisers implementing ESG, it is the first globally consistent and robust assessment of ESG adoption, objectives, and asset manager perceptions.

The NMG Global ESG Study is the latest product from NMG’s London-based thought leadership team, developed to improve understanding of ESG as it moves rapidly from a niche application to a mainstream investment approach.

While consumers are becoming more active, ESG demand is mostly driven top-down by the stakeholders of large institutional and wholesale asset owners – including board members, representatives of business, trade unions, governments / regulators and community bodies. As such, stakeholders influence the investment strategy of multi-billion-dollar portfolios and ESG influenced assets are growing fast.

While there is regional and segment variation, the vast majority of asset owner adopters of ESG now integrate ESG into their investment decision making process. Asset owners implementing ESG typically start with their equity portfolio where the data is most comprehensive and, having done so, progressively move on to considering other parts of their portfolio. It’s notable that while public markets remain the focal point for ESG integration, application to private market portfolios and alternative investments is already important.

What matters most?

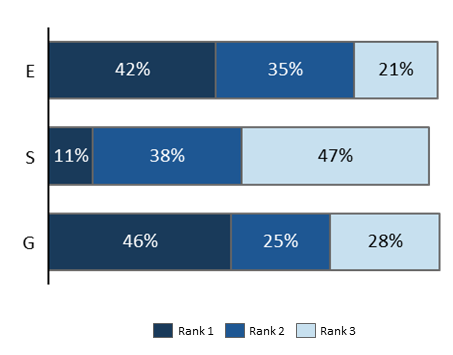

As Figure 1 below demonstrates, “E” environmental factors and “G” governance factors have a similar share of asset owner top ranked objectives, well ahead of asset owners selecting “S” social factors.

Figure 1 – Relative importance of E vs S vs G

Source: NMG Consulting

Source: NMG Consulting

However there are big differences between regions – environmental issues are most important in Europe and North America, while APAC asset owners focus more on “G” governance.

Asset owners are becoming more granular in their ESG objectives, with specific issues increasingly being targeted. In this year’s study the top five issues which assets owners are seeking to advance via their ESG policies were:

- Carbon emissions (E)

- Transparency (G)

- Pollution (E)

- Climate change (E)

- Financial disclosure (G)

Asset owners have come a long way from the days of negative screening of portfolios. Increasingly they look for investments which can make a positive contribution to their leading ESG objectives.

How do ESG adopters select their asset managers?

A key finding of the study is that while some asset managers are making significant ESG capability investments and are integrating ESG into their investment processes, asset owners are broadly sceptical of asset managers’ commitment to ESG values.

While asset owners want to buy ESG solutions from asset managers, the ESG message doesn’t always resonate consistently within asset management firms, with a lack of unanimous buy-in or evident stakeholder conflict. Dissonance of this nature can be evident to asset owners looking in from the outside.

Setting aside wider consideration of values, regulations and fiduciary duty, and recognising that an investment is required to participate, the question for asset managers is whether to treat ESG as a hygiene factor, similar to a risk management policy; or as a critical selection factor which ranks alongside process and performance, and which therefore should be a central focus of the entire organisation.

The consideration and selection of asset managers by asset owners works in two main ways:

- ESG-specific products: the traditional offer of specialist ESG managers, but now represents the smaller part of the ESG opportunity.

- ESG-prescribed mandates: conventional mandates for equities, fixed income etc. but with an ESG overlay prescribed by the asset owner which the asset manager is expected to implement. The asset manager needs a combination of traditional investment skills, ESG capabilities, and value alignment. This now forms the majority of the ESG opportunity.

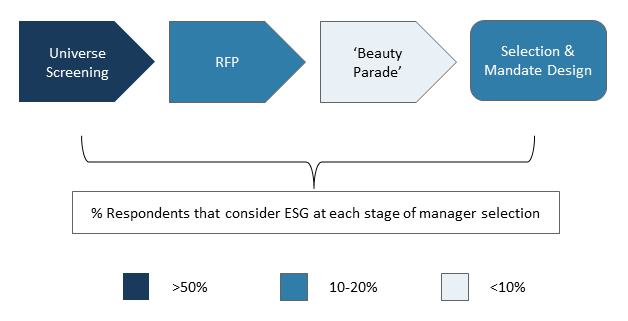

The selection process for ESG products or mandates has significant parallels to conventional products, but with ESG considerations at different parts of the process. As Figure 2 indicates, this is most common at initial universe screening – many managers are never aware that they are screened out at the very start of the process. However investors also apply it at later stages of the process, something we expect to become more prevalent.

Figure 2 – ESG consideration process

Source: NMG Consulting

An asset manager must expect intense scrutiny from the asset owner ESG specialists who will look for values alignment. Managers need to secure buy-in from their investment teams otherwise they run the risk of being seen by customers as lacking commitment, or worse, greenwashing.

The Global ESG Study delivers insights to the size, shape, momentum and trajectory of ESG integration among asset owners and their views of the ESG capabilities of asset managers by region and market. The study can be used as an evidence base for ESG marketing strategy, including understanding the opportunity, identifying target segments, and positioning choices; as well as to support internal advocacy and product design / development.

Fieldwork was conducted between April and June 2019 and comprised a large sample of investors actually undertaking ESG implementation – from long-standing experts to those early on the journey. Respondents were key ESG decision-makers able to discuss how the investor considered and made ESG-related decisions.

For more information, contact:

Mark Fox, Senior Consultant (London; [email protected])

Andrew Baker, Partner (London; [email protected])