Economic Overview

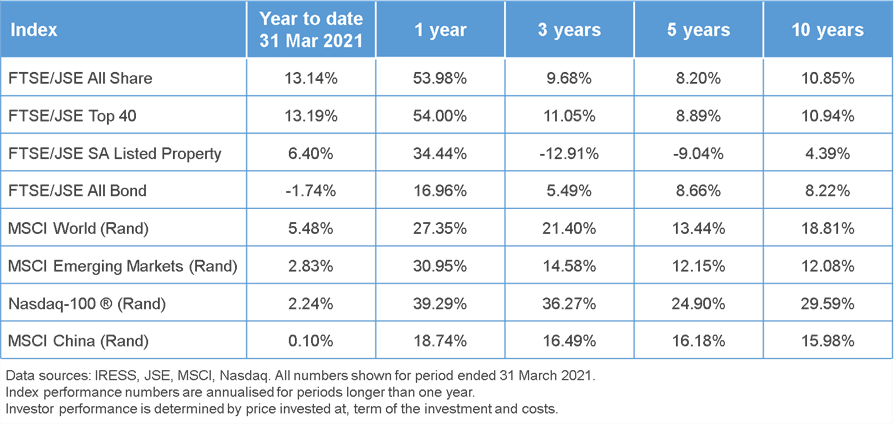

Internationally, the first quarter of 2021 ended on a positive note; and locally, the FTSE/JSE All Share and local equities also performed well. As the one-year rolling returns no longer include the poor performance that was experienced March 2020, the recovery looks impressive: a massive increase of 53.98% for the All Share Index. Emerging markets have remained slightly ahead of developed markets.

In more good news, the South African Rand has strengthened against the US Dollar. Just over a year ago we were experiencing exchange rates in excess of R18 to the dollar; in April 2021 it has remained consistently under R14.50.

As the Covid-19 vaccine rollout gains momentum around the world, optimism is rebounding, and this has a direct positive effect on global stock markets. However, bonds have not performed as well, due to the expectation of higher inflation rates in the near future.

Unfortunately, not all the news is good. With the approach of winter, load shedding is once again rearing its unpleasant head. South Africa has received a warning from credit ratings agency Fitch in this regard, stating that “any increase in unplanned losses would increase load shedding for customers and costs for Eskom, further pressuring its standalone credit profile”.

Furthermore, the vaccine rollout in South Africa has seen more than its fair share of hiccups, with barely 0.5% of the population having received the jab to date. There is very little chance of the country achieving herd immunity in the next twelve months. Some of the reasons for this state of affairs include health inequality, the government’s delay in arranging for vaccine procurement, issues regarding the efficacy and side effects of the various vaccines, and obstacles regarding the agreements that were made with vaccine providers. In short, the longer it takes for South Africa to achieve herd immunity by vaccinating 67% of the population, the longer it will take for our economy to recover, and many lives – and jobs – will be lost along the way.

The information in this communication is for information purposes and is not intended to be detailed advice described in the Financial Advisory and Intermediary Services Act. The fund, administrator and trustees cannot be held liable for damage or loss suffered as a result of any action that you take based on the contents of this communication.