Why 20 Percent Matters

Topics in 401(k) Distribution: Third in a Series

Close to half of all 401(k) advisors are all but ambivalent when it comes to business development; half say their prospecting activity today compared to a year ago is about the same, nearly half (46 percent) say as much for their proposal activity.

In fact, with respect to proposals, almost as many advisors say they are less active today (24 percent) as say they are more active (29 percent, down from 40 percent in 2015). Are advisors just cruising?

As always, the answer depends on which advisors. In terms of proposal activity, Light advisors (less than 20 percent of practice income, 46 percent of advisors) are exerting less effort by 31 percent to 18 percent (48 percent about the same). But Medium advisors (20 percent to less than 60 percent of practice income, 28 percent of advisors) are putting out more proposal effort by 39 percent to 18 percent (43 percent about the same) as are Heavy advisors (60 percent or more of practice income, 26 percent of advisors) by an almost identical ratio.

Prospecting activity follows the same pattern with Lights less active by 24 percent to 22 percent and Mediums and Heavies more active by 43-12 percent and 37-14 percent respectively.

Does the 20 percent of practice income threshold really separate the leaders from the followers?

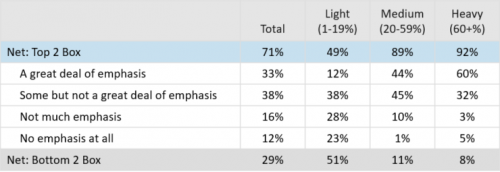

We think so. Only 12 percent of Light advisors expect to place a great deal of emphasis on their 401(k) business in the year ahead even as 44 percent of Medium and 60 percent of Heavy advisors take that position. A narrow majority of Lights (51 percent), in fact, are looking to place little or no emphasis on 401(k) in the year ahead while about nine in ten Medium and Heavy advisors (89 percent and 92 percent respectively) are loading some or a great deal of emphasis into this aspect of their practices.

Which advisors would you rather have on your team?

Emphasis on 401(k) Business

By 401(k) share of Income

About the Research

Retirement Services Intermediaries studies were launched in 2000 by Brightwork Partners LLC; Brightwork was acquired by NMG Consulting in 2017. Findings are based on selected RSI waves carried out between 2005 and 2018. These studies are conducted by telephone, typically among a representative cross-section of 600 or more advisors deriving income from 401(k) plans. RSI 12 is scheduled for delivery by year-end 2018.

About NMG Consulting

NMG Consulting (https://nmg-group.com/businesses/nmg-consulting/) is the leading multinational consultancy focusing solely on investments, insurance and reinsurance markets. NMG works with financial organizations to shape strategy, implement change and manage performance. NMG Consulting has approximately 100 employees spread across offices in Sydney, Perth, Singapore, Cape Town, Kuala Lumpur, London, Toronto, Kansas City and Stamford. The firm was established in 1992.

For more information

Merl W. Baker, 203.487.2000; [email protected]

Where to now?

Shape your thinking: The NMG Consulting proposition.

Our Library of Insights: Trusted by industry leaders.

Follow NMG Consulting on LinkedIn and be the first to read our latest insights and company news.