The world, the markets and your investments

Black Swan – that’s what hit the world in the first quarter of this year. 2020 was expected to be one of slow and steady economic growth, carrying the momentum from the end of 2019. However, COVID-19 and its impact was a black swan event that no one could have predicted.

“A black swan is defined as a rare occurrence that has a catastrophic impact”

What began in mainland China resulted in fear worldwide. By the end of February, the virus was spreading meaningfully around the world and markets fell, but March was when the pain was truly felt.

Countries began to close their borders and instilled strict limits of personal contact and distance as the World Health Organization declared it a global pandemic. The world, the financial markets and investments were impacted. To begin, let’s determine how severe the market reaction was.

The fear that the virus caused around the world spread quickly to investors. As investors began to run to ‘safer’ assets such as cash (and gold), every other asset class fell, and fell with brutal force.

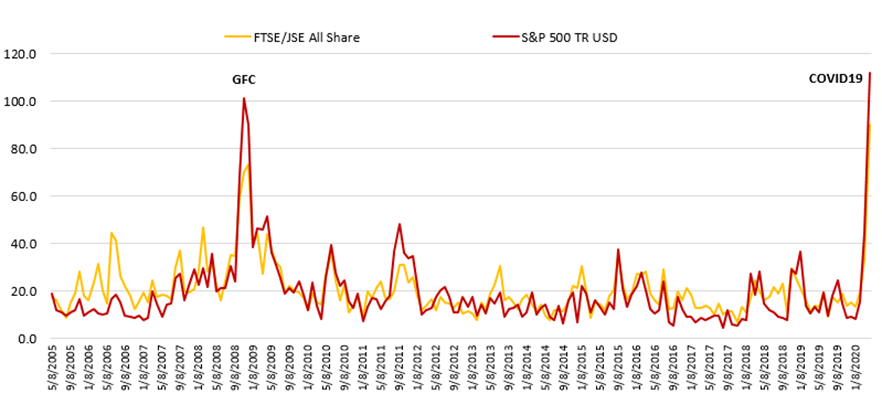

The VIX index, also known as the investor ‘fear’ index, hit all-time highs. To give an idea, the volatility in the South African markets and the US is shown below. In SA, it hit an astounding 93% in March (it only reached 73% during the Global Financial Crisis in 2008). In the US, it hit 112%, while in the Global Financial Crisis it hit 101% – astronomical.

It is clear we are living in extraordinary times.

Volatility (measured by standard deviation) in the SA and US market hit all-time highs during March 2020.

What has happened to markets and investments?

Markets have suffered. March saw eye-watering negative returns. The US market dropped -12.4% for the month and the SA market dropped -12.1%. It did not stop at equities, as SA property declined -36.6% and even bonds (usually seen as a relatively ”safe” assets) fell -9.8%.

It should come as no surprise that investment portfolios would have been affected. Everyone has suffered. However, as investment portfolios invest in diversified types of assets – both locally and internationally – this has limited single-risk exposure to one asset class. However, a common occurrence during crises is for all assets to react similarly, and unfortunately this was all negatively. Saying this, saving for retirement means long-term saving, where you are bound to experience market corrections and crashes (as well as recoveries) over time, even if they are extreme.

Saying this, it is crucial not to panic, as we have seen many investors ‘dash for cash.’ From the last week of March, markets rallied upwards and the gains were significant.

In the last week of March alone, the equity market gained 8.3% and bonds gained 9.1%, and it did not stop there as the markets appeared to u-turn in direction. April saw extremely positive returns, with local equities up 14% for the month and international equities up 15%. Property gained 7% and bonds gained 4%.

Imagine one had dis-invested at the bottom, mid-March (“dashed for cash”) and lost out on this recovery?

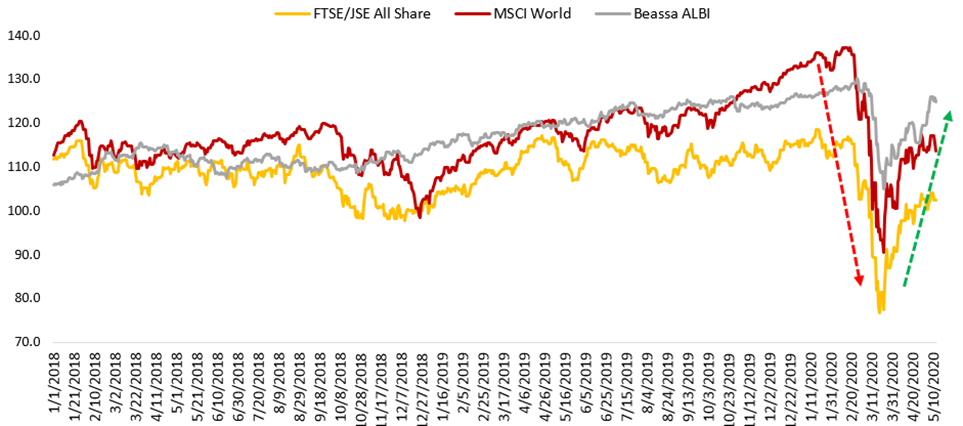

The sharp drop and bounce back can be seen below.

As the bottom of the sharp decline was hit, markets bounced back in the last week of March, and continued into April.

Year-to-date, most portfolios are still trying to recover from the market turmoil. However, the gains in these recent weeks have been crucial in recovering some of the severe losses.

Where to now?

It is easy to become fixated on short-term numbers, especially when they are extreme, such as the current environment we are in. At a time of COVID19, oil price crises and ratings downgrades, it’s a difficult time to address retirement investments. However, it is important to focus on the long-term, no matter how painful the short-term is.

Your underlying asset managers maintain a careful view on the current situation, which still has much uncertainty and high volatility. There are many views that great buying opportunities have been created, but the investment managers are cautious about acting too soon. As in all crises, a recovery will come, it’s just when that will be that is uncertain. There are many views on where we are in the market, whether we are out of the bottom or whether more pain is to come, and unfortunately we do not have the luxury of a crystal ball.

Remember, it’s about time in the market and not timing the market.

The information in this communication is for information purposes and is not intended to be detailed advice described in the Financial Advisory and Intermediary Services Act. The fund, administrator and trustees cannot be held liable for damage or loss suffered as a result of any action that you take based on the contents of this communication.