In a class of their own

September 2018 | Reinsurance BrokingDownload

Reinsurance brokers are an essential part of the value chain for P&C reinsurance globally. In fact, reinsurance brokers are so interwoven into the overall reinsurance proposition for P&C, it feels as if the term ‘intermediaries’ might no longer be appropriate.

Reinsurance broking might also be an increasingly incomplete description – brokers have extended into areas of consulting and have invested significantly in high-tech models and analytical tools as potential sources of value-add and differentiation.

Globally, we’ve identified more than 100 active reinsurance brokers (honestly!), and over 150 reinsurers of different shapes and sizes. The number of competitors is however of limited relevance. Industry executives talk about the ‘Big 4’, sometimes the ‘Big 3½’, as well as the level of dominance of the two largest: Aon Benfield and Guy Carpenter.

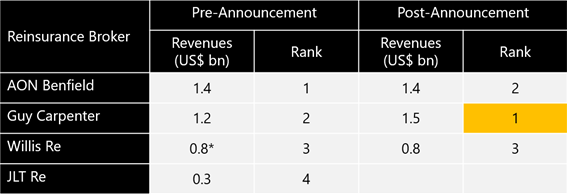

Marsh’s 18-September announcement of its acquisition of JLT for US$5.7bn, might actually have a greater impact on the competitive landscape of the reinsurance segment than it does in insurance broking. The ‘Big 4’ will reduce to the big ‘Big 3’ and will secure for Guy Carpenter the mantle of being the largest reinsurance broker (although only narrowly). Assuming limited shrinkage through the integration, the gap in annual revenues between second and third positions is the other noticeable outcome: expanding by US$200m, larger than the new fourth-ranked competitor.

Exhibit 1

Note: Revenues are as at December 2017; *Willis Re is based on 2015 financials

The rationalisation of these two businesses should prove compelling: JLT Re clients will likely experience the benefits of Guy Carpenter’s deeper capabilities in areas that include analytical modelling, actuarial management, thought leadership and innovation. There will also clearly be significant cost synergies to return to Marsh shareholders, reflected in the one-third premium on market value on which agreement has been based.

Economies of scale and scope are clear sources of competitive advantage for reinsurance brokers, and it certainly helps too if a reinsurance broker’s ‘big sister’ company is a key distribution channel of their insurance clients. It becomes hard to see how smaller reinsurance brokers can compete (at any meaningful scale) against these assets, although in reality the Marsh announcement didn’t change anything in this respect.

Will we see further consolidation in reinsurance broking? Smaller firms are too small to move the dial for likely acquirers, and with circa 20 genuinely global insurers and 12 genuinely global reinsurers, three large firms would surely seem to be the minimum level of choice.

Our authors

Jane Cheng is a Principal Consultant based in Sydney ([email protected])

Shashini Abeygunawardena is an Analyst based in Kuala Lumpur ([email protected])