The six forces reshaping P&C insurance

September 2018 | P&C InsuranceDownload

Segments of the P&C industry are gripped – mostly positively – in a cycle of technological solution development, and there are increasing levels of investment in innovation in general. Digital, no longer just a channel, has become an essential feature of all personal lines products (and some commercial lines too). Digital transformation is indeed upon us, and InsureTech is more than just a passing phase.

With justification, the P&C industry also remains deeply concerned about a seemingly permanent abundance of capacity at current prices, and what this means for price adequacy. When the market eventually normalises, will the transition be orderly or disruptive, or could it be that the industry is simply operating in the new normal?

While these are the two leading forces shaping P&C insurance globally, the drivers of industry change do not stop there. We’ve identified six forces currently shaping the competitive landscape. It follows therefore that even if capital levels were to revert towards historical norms, the five other factors will likely remain actively in force. Insurers and investors should thus reasonably prepare and invest for an extended process of metamorphosis.

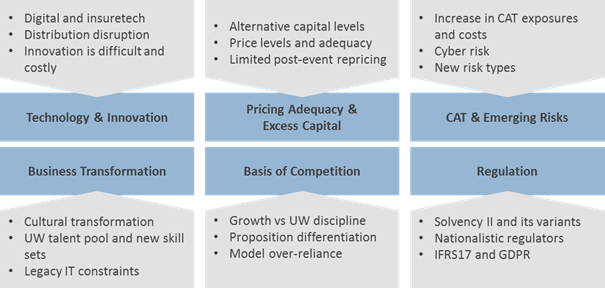

Six forces with global effect

Exhibit 1

The relevance and importance of each of these forces understandably varies between regions and across markets, but the point of significance is that these are visibly at play in all markets.

To see a dynamic representation of these change drivers across seven regions, click on the chart below that follows to view an infographic:

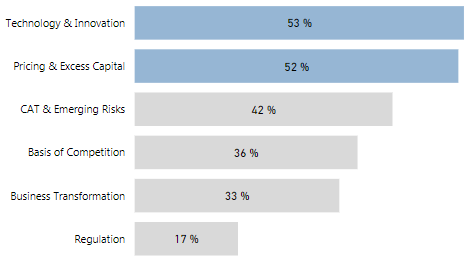

Exhibit 2: Six forces active globally

Source: NMG Consulting’s Flaspöhler Study – P&C Reinsurance – 2017/18

Digital transformation is the dominant driver in the insurance markets of Continental Europe, more so than any other region (and by a wide margin).

In contrast, issues around excess capital levels and pricing adequacy are the leading challenge in the UK, demonstrating a market profile more closely linked to that of the intensely price-oriented markets of Asia than the similarly mature markets on the Continent.

2017’s large losses in North America served as a timely-yet-painful reminder about potential CAT exposures globally. And there is a growing awareness about the impact of exposures to Cyber Risk, and several other changing risk profiles. CAT and newly emerging risks are advancing as a shaping force in all regions.

The deeply technical US markets are going through a period of significant transformation, facing a potential crisis in talent and approach. Human versus machine, underwriter versus model; this when coupled with the parallel revolutions in distribution and technology translates to the US market being affected by transformation more than any other.

Something that won’t change any time soon is that insurance – given its social and economic importance – is a highly regulated segment, meaning it features in all regions studied. Unsurprisingly to Australians, regulation plays a greater role in shaping the markets of Australia & New Zealand than in any other region.

Our authors

Mark Prichard is the CEO of NMG Consulting based in Sydney ([email protected])

Jane Cheng is a Principal Consultant based in Sydney ([email protected])

Kevin Lin is an Analyst based in Sydney ([email protected])