Global Performance & Importance – Reinsurers – 2018

December 2018 | Property, Casualty & Specialty ReinsuranceDownload

Despite receding in degree, a leading concern for insurers and brokers globally is the prevailing level of excess supply driven by alternative capital, and consequent pricing levels. We have identified six global forces that are active in each of the (seven) regions analysed, with ‘digital transformation and innovation’ now being viewed as the leading challenge.

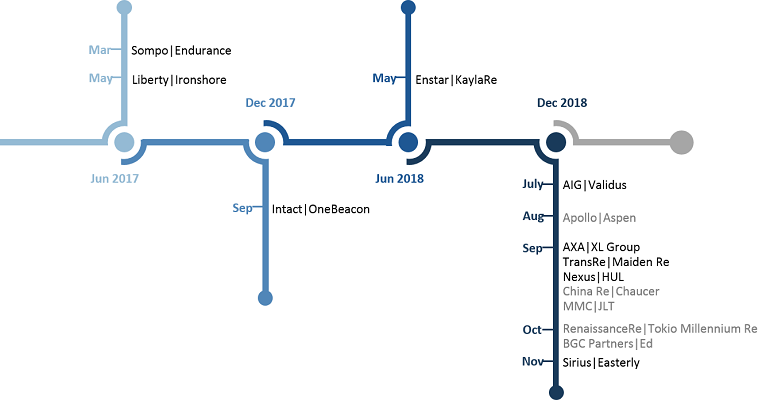

These change drivers are the shaping forces behind industry consolidation, the pace of which has been quite remarkable. The past 24 months have seen the formation of the world’s largest commercial lines insurer (AXA XL) and several reinsurance acquisitions: Trans Re/Maiden, Apollo/Aspen, AIG/Validus, and most recently RenRe/Tokio Marine Reinsurance (TMR).

Exhibit 1: Consolidation activity – 2017 & 2018

The biggest news in insurance broking for 2018 is Marsh’s acquisition of JLT, which will have significant ramifications for the reinsurance broking segment. Once integrated, the combined Guy Carpenter and JLT Re will have similar market penetration to Aon Benfield within each of the key regions, creating two clear scale leaders for the segment.

Ed – the world’s fifth largest reinsurance broker – announced its acquisition by BGC Partners (a global intermediary and technology company) – seeking growth capital and possible synergies.

2018 is set to be a record year for reinsurance transactions, although the P&C reinsurance industry has been reshaping for a while now.

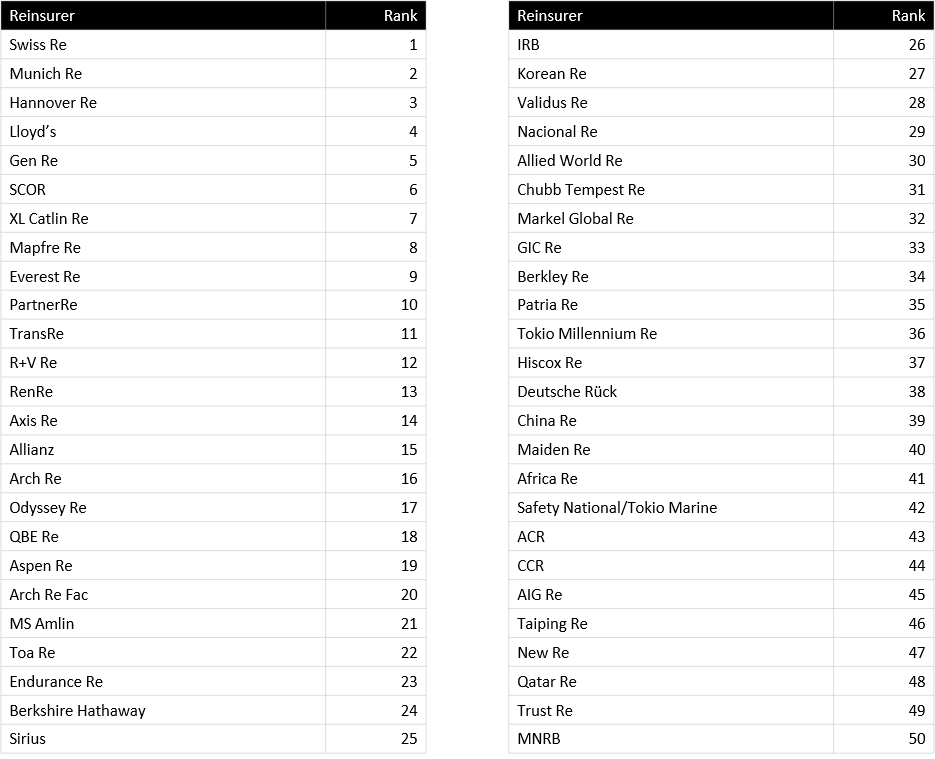

Brand is an essential element of the value proposition for reinsurers.

Our ratings and rankings for Brand Strength are derived by factoring the unprompted views of insurers and brokers as to the “most well-regarded brands”, partner preferences and also specialist recognition within lines of business across 30,000 data points in 2018.

Exhibit 2: Top 50 brands – Global

Source: NMG Consulting’s Flaspöhler Study – P&C Reinsurance – 2017/18

Swiss Re is the leading brand for P&C reinsurance globally and within all but one of the major regions. See Brand Strength Rankings to learn how these vary across the world’s major regions.

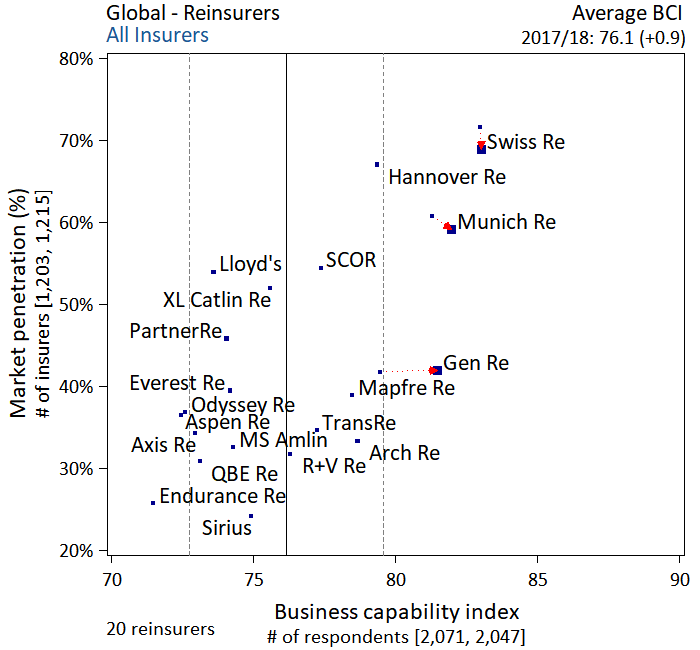

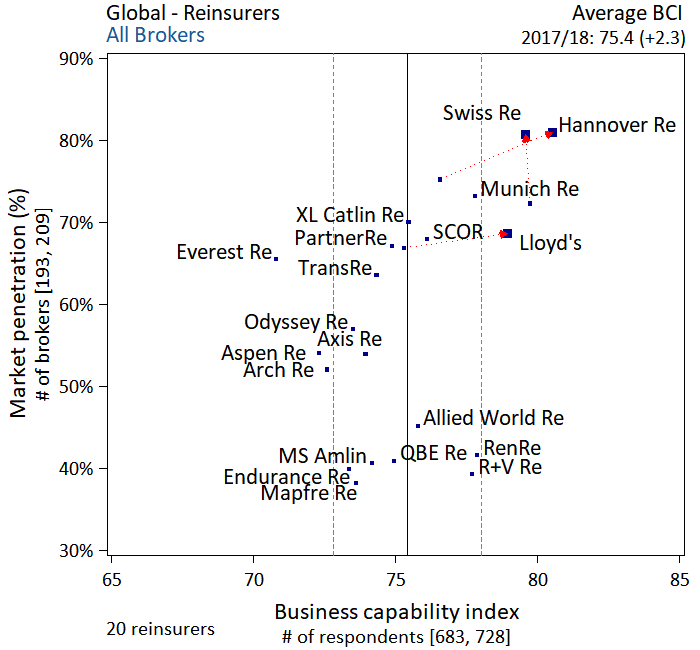

Competitive positioning – Reinsurers

Exhibit 3: Business Capability Index – Global

Source: NMG Consulting’s Flaspöhler Study – P&C Reinsurance – 2017/18

Swiss Re was again top ranked globally on NMG’s Business Capability Index (BCI) incorporating the views of ~2,000 insurance executives globally. Hannover Re – lifted by a strong year in the US & Canada –carried the leading global result among brokers.

Value attributes rank highly in reinsurer selection, especially ‘partnership’, ‘ease of doing business’ and ‘timeliness’ (all of which are notably higher rated than underwriting capability). The greatest sources of differentiation between reinsurers are to be found in overall relationship management, underwriting, thought leadership and innovation.

Insurers indicate that innovation is a lower-ranking factor in the selection of reinsurance partners. Even more striking is the relative absence of ‘innovation’ in the brand associations of reinsurers (particularly as compared to Life & Health reinsurers).

Exhibit 4: Brand association for reinsurers

Source: NMG Consulting’s Studies of Life & Health and P&C Reinsurance – 2017/18

So, are reinsurers to blame, or have they simply (rationally) focused on customer engagement (and price) alone in a market where propositions are commoditised? We wonder how much do the legacy operating styles of the days of the hard market contribute?

Our author Mark Prichard is the CEO of NMG Consulting based in Sydney ([email protected])