The importance of being different

October 2016 | Life & Health Reinsurance

By Mark Prichard and Rick Flaspohler: Download

‘One size fits all’ service models are increasingly unsustainable, and as such reinsurers are beginning to implement more refined customer segmentation strategies to remain competitive. Reinsurance competitors need to embrace their differences for these to have the desired effect.

When does twenty equal four lots of itself? This is known to economists and statisticians as the Pareto Principle. And even those who have read best-selling management consulting books dedicated to the subject can still be surprised by how often the ‘80/20 rule’ is evident in business. Its essence: the fact that a relatively small number of customers move the dial disproportionately in terms of revenues, and often even more so for the bottom line.

Examples of the 80/20 rule appear with regularity in each of the industry segments in which NMG Consulting operates (insurance, reinsurance, wealth/retirement, and asset management), and are visible in both B2C and B2B settings.

While there are variations between reinsurance competitors, in the life reinsurance segment the 80/20 principle is evident within the business portfolios of each of the leading reinsurers, despite their diverse and numerous client bases and their global scope.

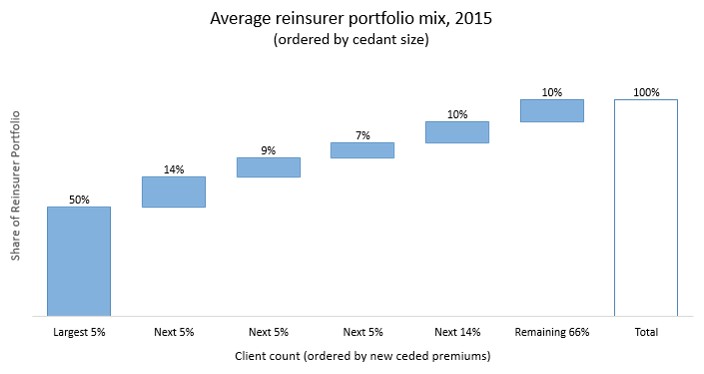

An averaging across the portfolios of the global competitors reveals that one-half of current business portfolios for ‘traditional’ reinsurance business is sourced from the largest 5% of clients. This assessment is based on new ceded premiums, itself a blended metric encompassing both individual and group business. In NMG’s global database, the top 20% of the average reinsurer’s clients coincidentally account for exactly 80% of total revenues (a simple average across competitors). Sixty-six percent of clients, that is the smallest two-thirds by new ceded premiums, contribute just 10% of the business portfolio. Competitors can’t be blamed for drawing similar conclusions.

Reinsurers’ operating expense ratios typically average between 4-6% of reinsurance premiums; well less than half of those of most insurers. Nevertheless, reinsurers rightly also place significant focus on expense management as profit margins relative to premiums are also considered to be low (compared to say asset management). As reinsurers have to invest additionally to compete for the largest cedants, given a finite resource base it follows that they would not be able to invest at the same level for smaller cedants. Customer segmentation and differentiated service models have necessarily emerged as a consequence.

Hypothetically, were a reinsurer to attempt to offer the same service model to all customers, it would necessarily be less attractive to the biggest clients unless it chose to compensate by offering lower prices. This reinsurer should then in theory compete favourably at smaller accounts, but would soon struggle to justify the associated servicing costs relative to revenue, thereby moving into the precarious territory of declining revenues and increasing expense ratios. To use a well-known life insurance analogy: it would be the equivalent of charging aggregate rates when competitors are offering discounts for non-smokers. The consequences are predictable, but not desirable.

In 2016, the largest cedants already receive the benefit of lower pricing. Some of the world’s ‘mega-cedants’ view the pursuit of new innovations to lower the cost of reinsurance as a core competence. For reinsurers, this approach can only go so far. Reinsurers’ rates are in effect bets on the future incidence of mortality and morbidity within reinsured portfolios, involving assumptions which comprise significant uncertainty given the extent to which these exposures are deferred. Price-led strategies therefore operate with clear constraints, and reinsurers bear several recent scars of underperforming blocks from market cycles where pricing proved too optimistic (most notably in the USA and Australia).

Increasingly refined approaches to client engagement, combined with relevant capability differentiation and deeper and more value adding client servicing, should allow reinsurers to achieve higher margins at their most important clients. If reinsurers fail to differentiate their segmentation models sufficiently however, and adopt approaches that are more similar than dissimilar, then there could be unintended outcomes of these models focused on customer targeting and engagement. Competition for the largest cedants could become ever-more intense. At the same time smaller cedants could end up with insufficient attention from all reinsurers, and receive increasingly little service. It is thus a conceivable risk that an unintended consequence of service differentiation could be compressed margins at large accounts and commoditisation at smaller accounts. In our analysis, we can already see evidence of this emerging.

Reinsurers should therefore logically resist the temptation to simply imitate their competitors, and strive to devise models which uniquely reflect their own world view and approach to business. Vive la différence!

Insurers should think carefully too about how best to present their needs and interests to reinsurers. Restricting an engagement model to solely the technical requirements for managing volatility will almost certainly be limiting for insurers, significantly compromising reinsurers’ willingness to make their capabilities available to their company. Our analysis also points to several examples of where reductionist positions held by insurers have proved constraining. Arguably, an opportunity wasted.